Shareholders and investors are important stakeholders for

the JR East Group. We update our action to implement

management that is conscious of the cost of capital and stock price

each half-year. The Company’s price-to-book ratio (PBR), which

indicates the stock market’s evaluation, is the product of return

on equity (ROE), in other words the rate of return, multiplied by

the price-earnings ratio (PER), which reflects anticipated growth.

Therefore, we will increase PBR by both raising the rate of return and

improving growth expectations.

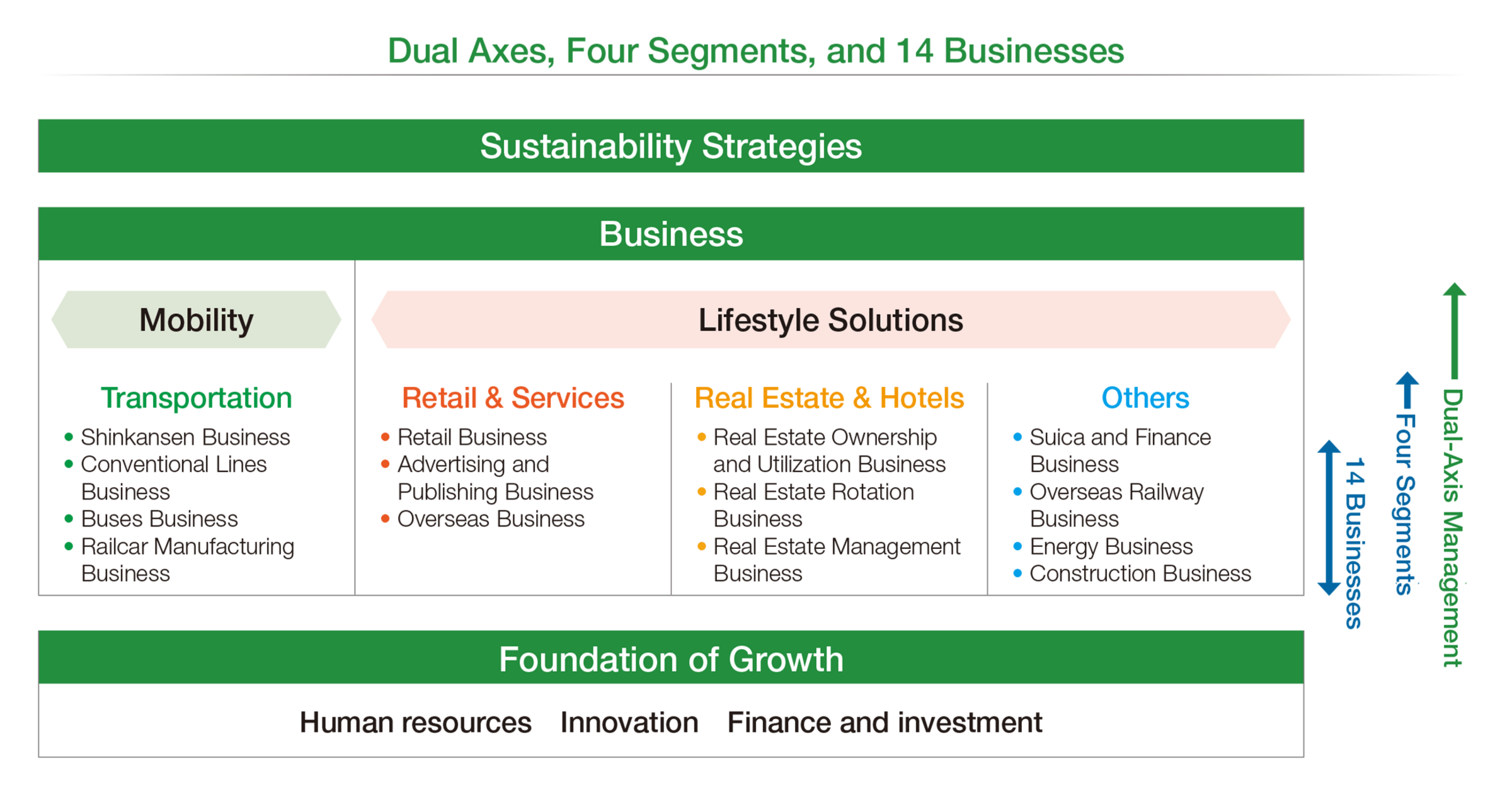

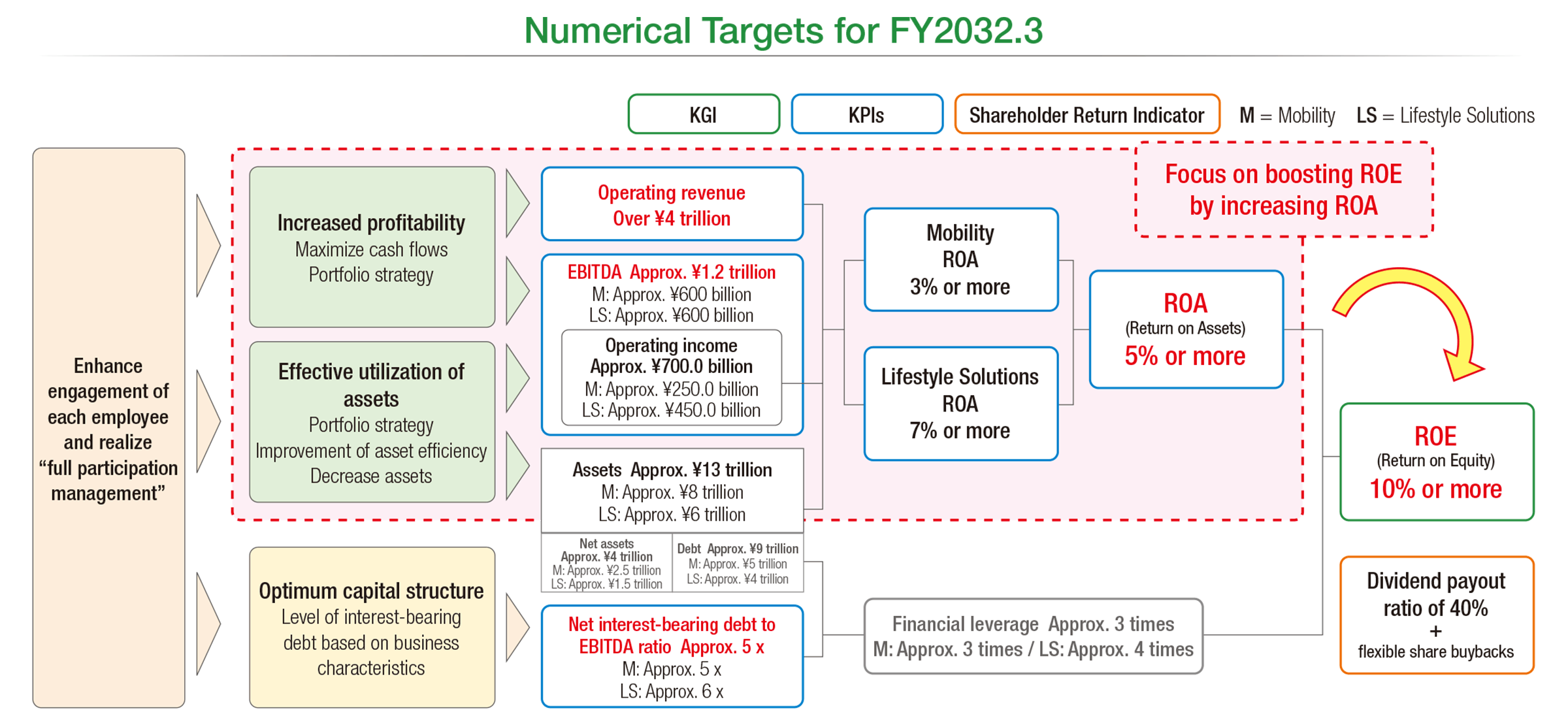

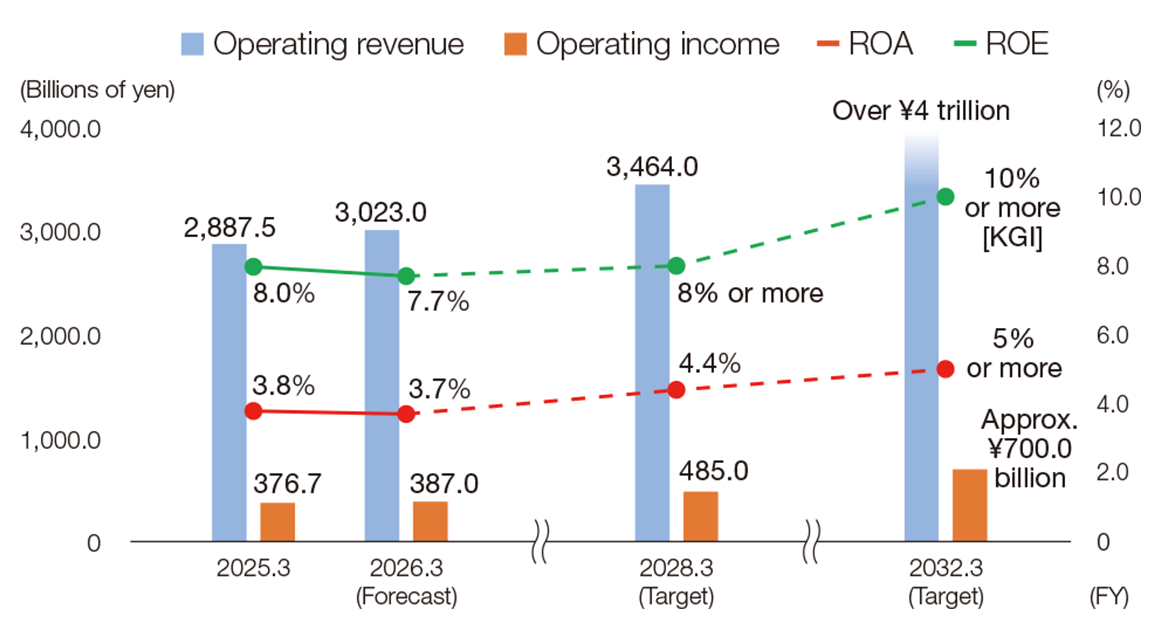

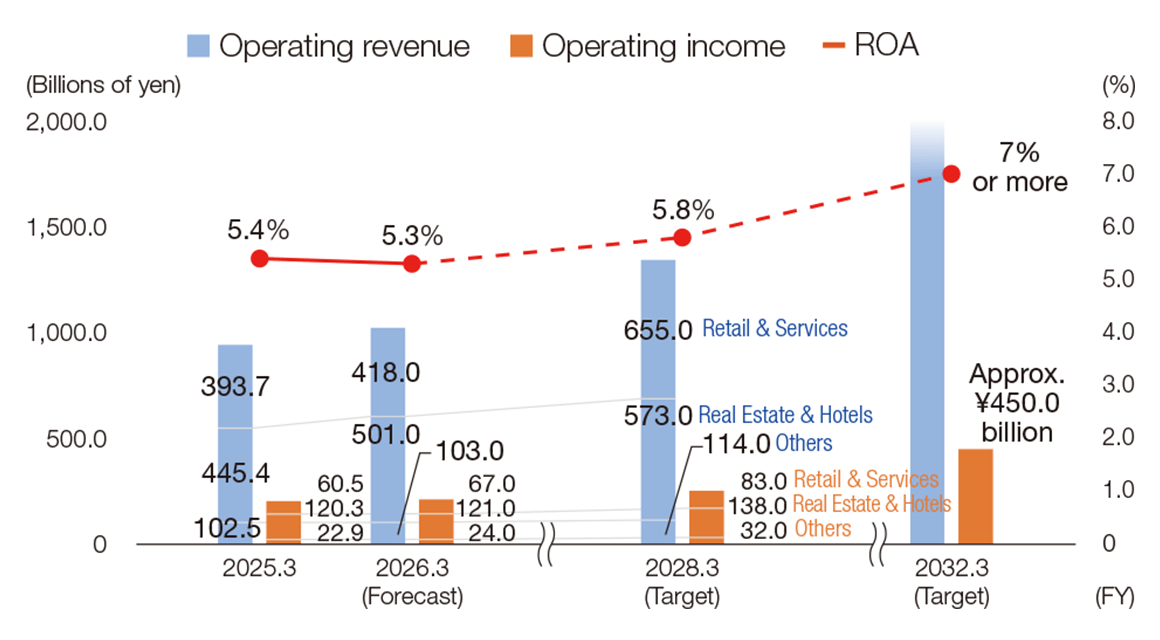

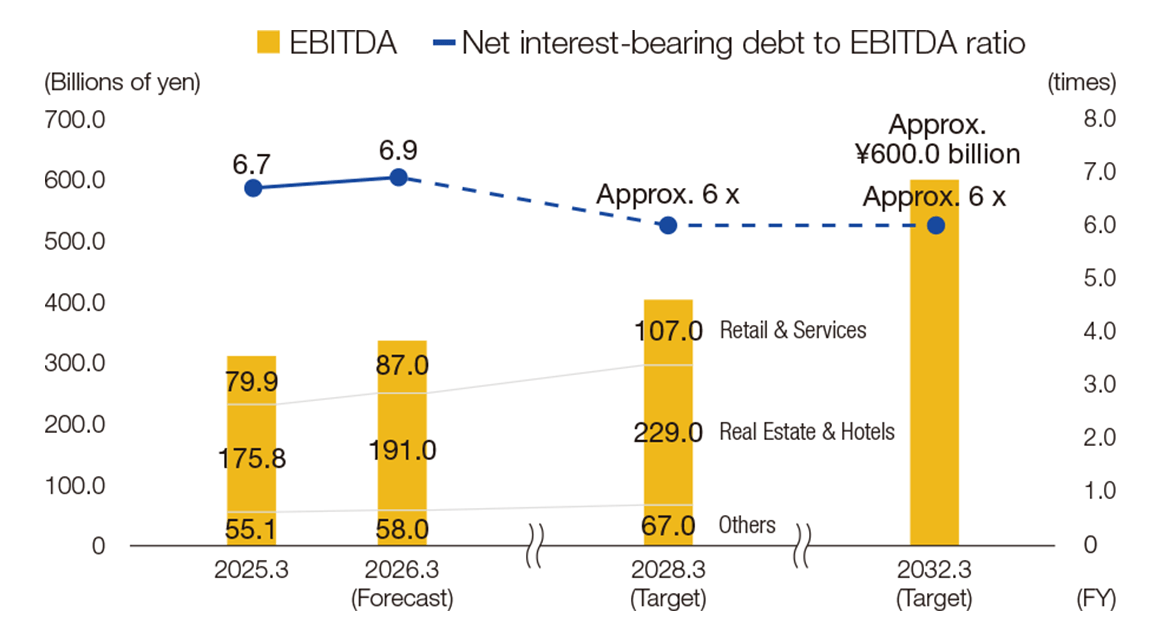

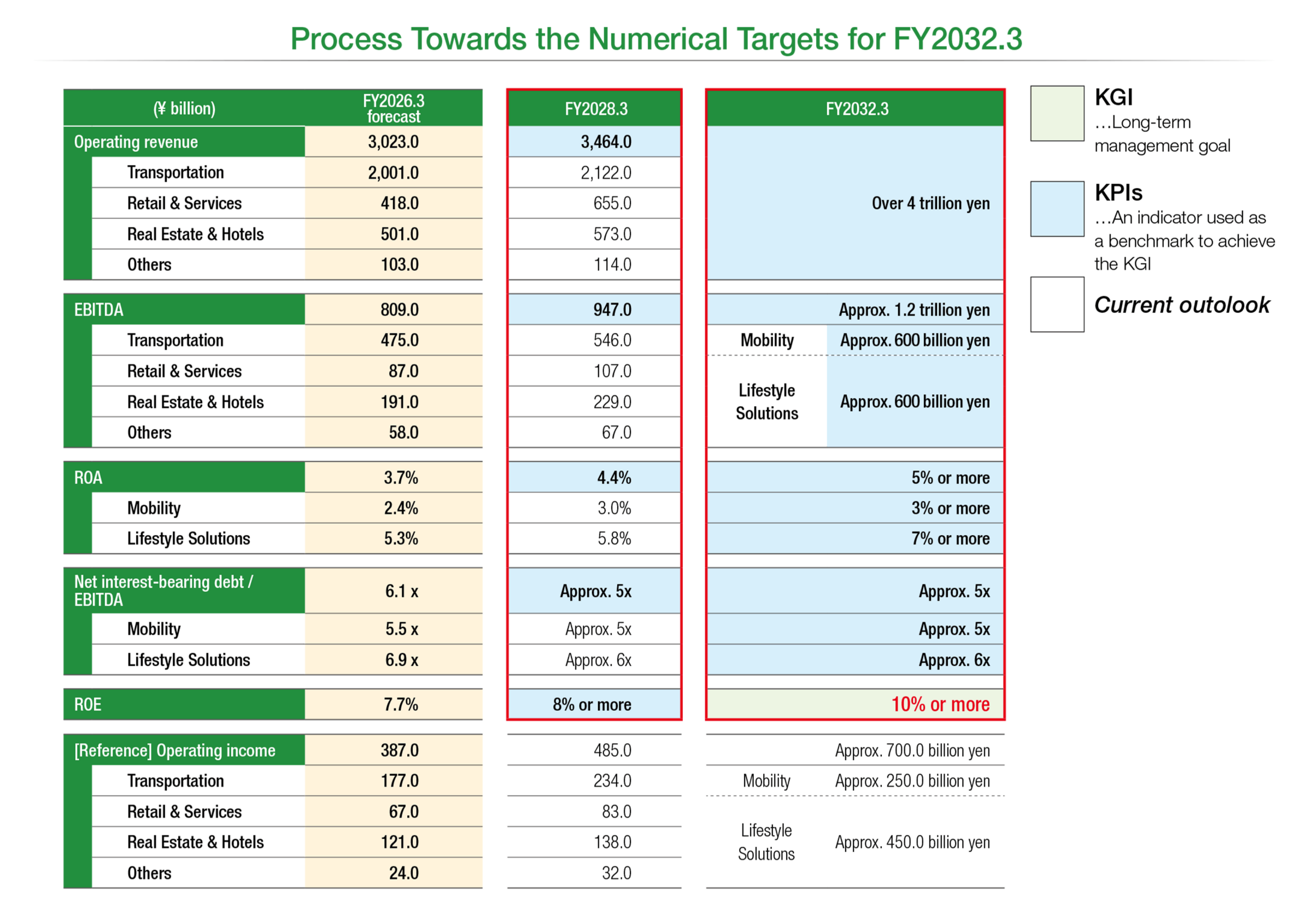

We have made ROE our KGI under “To the Next Stage” 2034,

to clearly convey the Group’s growth story to a wide range of

stakeholders, including the capital markets. By improving the

profitability of each of the dual axes and effectively utilizing assets as I

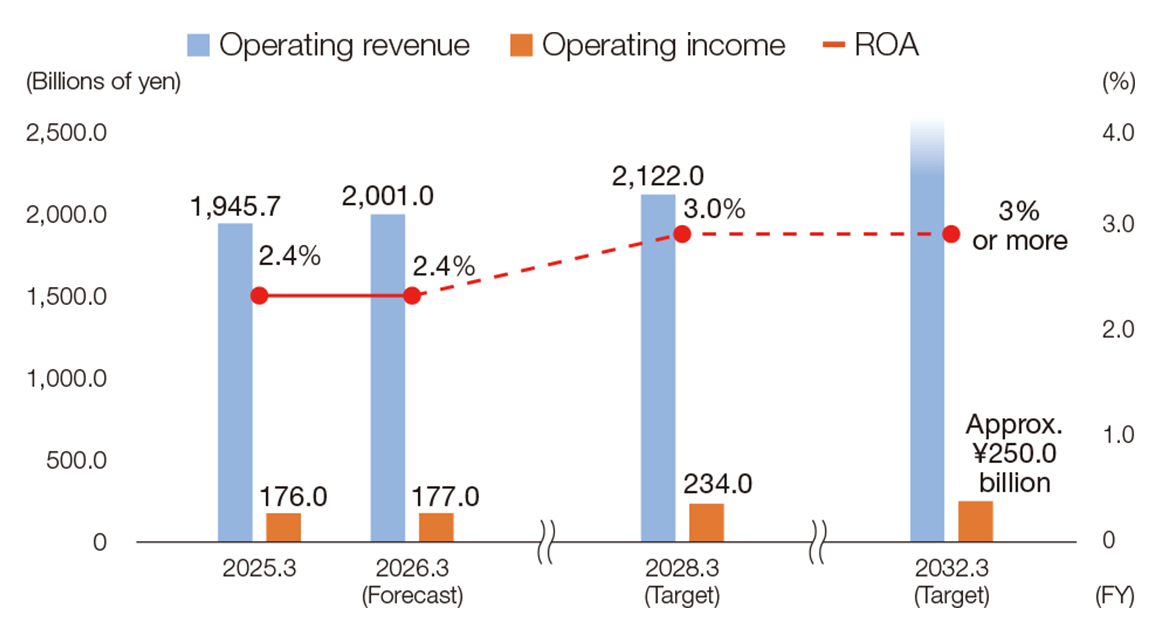

have explained so far, we aim to raise ROA to 3% or more in Mobility

and 7% or more in Living Solutions, achieving an overall ROA of at

least 5%. In this way, we aim to attain an ROE of 10% or more.

At the same time, we aim to reduce the cost of equity and

enhance the expected growth rate to improve the PER. We

recognize that the cost of equity is around 6% to 7%, given the

level of the market’s expected return that we have gauged through

Shareholders and investors are important stakeholders for

the JR East Group. We update our action to implement

management that is conscious of the cost of capital and stock price

each half-year. The Company’s price-to-book ratio (PBR), which

indicates the stock market’s evaluation, is the product of return

on equity (ROE), in other words the rate of return, multiplied by

the price-earnings ratio (PER), which reflects anticipated growth.

Therefore, we will increase PBR by both raising the rate of return and

improving growth expectations.

We have made ROE our KGI under “To the Next Stage” 2034,

to clearly convey the Group’s growth story to a wide range of

stakeholders, including the capital markets. By improving the

profitability of each of the dual axes and effectively utilizing assets as I

have explained so far, we aim to raise ROA to 3% or more in Mobility

and 7% or more in Living Solutions, achieving an overall ROA of at

least 5%. In this way, we aim to attain an ROE of 10% or more.

At the same time, we aim to reduce the cost of equity and

enhance the expected growth rate to improve the PER. We

recognize that the cost of equity is around 6% to 7%, given the

level of the market’s expected return that we have gauged through

dialogue with shareholders and investors. We will reduce the cost

of equity and expand the equity spread through active dialogue

between the Company’s senior management, shareholders and

investors, as well as by clarifying the Group’s growth story through

the establishment of our KGI and the KPIs for each business axis.

We will also enhance the communication of our growth strategies in

each business through initiatives such as increasing the frequency of

our Investor Relations Days (IR Days) to twice each year and aim to

improve the expected growth rate.

The Group’s strength lies in each of our employees, who diligently

and sincerely performs their daily tasks while playing a leading role in

LX. Our ideal management is one in which each of our employees “

beyond the norm” to create new value with a sense of determination

to shape the JR East Group over the next 10 years. Going forward,

we will continue to seek deeper dialogue with shareholders and

investors, pursuing the enhancement of Group-wide corporate value

to exceed their expectations.

Revision of Railway Passenger Fares

Ever since the establishment of JR East in 1987, we have been

committed to creating a strong management foundation that does

not rely on fare increases, through efficient business operations

focused on securing income and reducing expenses, as well as

further improving safety, stable transportation, and service quality.

Meanwhile, however, the roles and services required of

railway businesses have become more diverse and advanced.

The business environment is expected to remain difficult due to

changes in customer lifestyles, rising prices, and a continuing

decline in the population along railway lines, as well as the need

to improve employee remuneration and benefits to secure human

resources.In December 2024, we applied for the first revision of

passenger fares revision for the first time since the establishment

of JR East, to respond to adverse changes in the business

environment while steadily advancing efforts to maintain and

improve safety and service, update rolling stock and facilities,

expand barrier-free facilities, and prepare for increasingly severe

disasters. This revision was approved by the Minister of Land,

Infrastructure, Transport and Tourism on August 1, 2025.

You can pinch out to zoom in.

You can pinch out to zoom in.