We analyze and evaluate the current situation regarding measures to realize management conscious of cost of capital and stock price, and update our future approach once every half-year for improvement.

Management Conscious of Cost of Capital and Stock Price / Dialogue with Shareholders and Investors

Latest Initiatives

Current recognition

You can swipe horizontally.

You can swipe horizontally.

| Item | Unit | FY 2014.3 |

FY 2015.3 |

FY 2016.3 |

FY 2017.3 |

FY 2018.3 |

FY 2019.3 |

FY 2020.3 |

FY 2021.3 |

FY 2022.3 |

FY 2023.3 |

FY 2024.3 |

FY 2025.3 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ROA | % |

5.6 |

5.7 |

6.3 |

5.9 |

6.0 |

5.9 |

4.5 |

- |

- |

- |

3.6 |

3.8 |

| ROE | % |

9.5 |

8.1 |

10.4 |

10.9 |

10.5 |

10.0 |

6.4 |

- |

- |

4.1 |

7.6 |

8.0 |

| PBR | x |

1.38 |

1.66 |

1.56 |

1.42 |

1.33 |

1.33 |

0.98 |

1.17 |

1.12 |

1.12 |

1.22 |

1.17 |

| ROIC | % |

5.3 |

5.4 |

6.1 |

5.7 |

5.7 |

5.6 |

4.2 |

- |

- |

- |

3.3 |

3.5 |

ROE

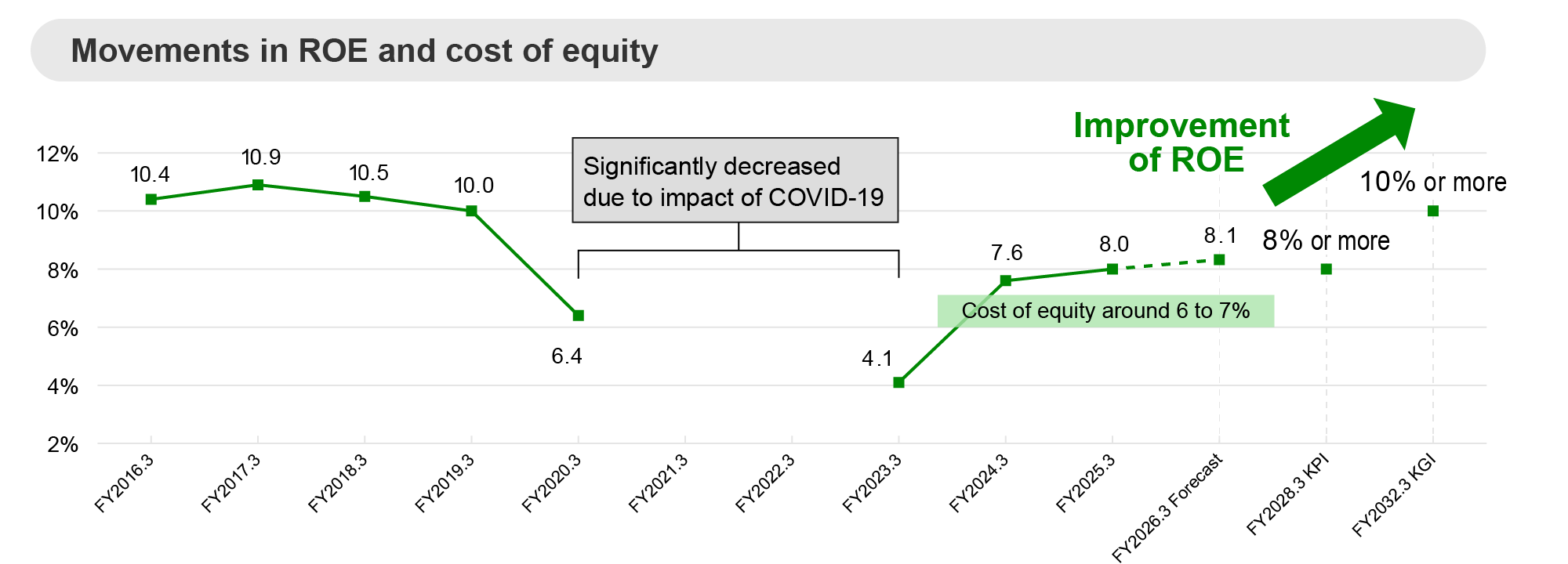

- We recognize that our cost of equity is around 6 to 7%, based on calculations from CAPM and the inverse of the PER, as well as discussions with shareholders and investors.

- We aim to further improve ROE to 10% or more in FY2032.3, which is one of the KGI targets of “To the Next Stage” 2034, and will reduce the cost of equity and widen the equity spread by enhancing dialogue with shareholders and investors.

PBR, PER

- After the announcement of “To the Next Stage” 2034, our stock price rose due to rising expectations for growth, and the PBR also rose to the same level as before COVID-19.

- Since PBR is the product of ROE (rate of return) multiplied by PER (growth expectations), we aim to improve PBR through both enhanced rate of return and increased growth expectations.

ROIC, WACC

- JR East's weighted average cost of capital (WACC) is calculated to be approximately 3%.

- ROIC for FY2025.3 was 3.5%. As ROIC is similar to ROA (return on assets), we aim to expand the ROIC-WACC spread by working to improve ROA in each of our dual axes of mobility and lifestyle solutions.

Action to Implement Management that is Conscious of Cost of Capital and Stock Price

- The overall picture of measures to realize management that is conscious of cost of capital and stock price is as follows.

- Considering that we operate in a capital-intensive industry with an extremely high proportion of fixed assets for business use, and that we hold a large amount of railway fixed assets with high public significance that are not easily sellable compared to ordinary businesses, the JR East Group aims to improve ROE and PBR through improving ROA.

You can pinch out to zoom in.

For details of specific initiatives, please refer to the Latest Initiatives materials.